Tag: Liquidnet

Liquidnet reports 57% jump in bond liquidity during volatile markets

Liquidnet has reported that the recent volatility led to an increase in bond trading volumes on the all-to-all block trading platform.

“In the last six...

The DESK’s Trading Intentions Survey 2020 : Unpicking the buy-side workflow

We reveal the buy side’s use of platforms for pre-trade data, executing orders in the market and trading venues.

Trading Intentions Survey highlights

Bloomberg has...

Subscriber

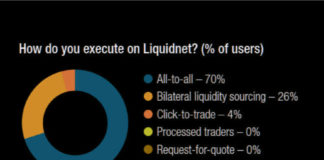

The DESK’s Trading Intentions Survey 2020 : Liquidnet

LIQUIDNET.

Liquidnet’s strength as a block-trading platform in the equity market may have paved its way for buy-side adoption in bonds, but it has certainly...

Subscriber

Europe’s liquidity rules are holding up… for now

New guidance on fund liquidity has followed redemption concerns in European equity and bond funds, writes Lynn Strongin-Dodds.

The risk that funds are unable to...

Seth Merrin stands down

Seth Merrin is to stand down as chief executive of Liquidnet, the US broker he founded almost 20 years ago. He will remain as...

Market reports: Algomi to be acquired

Market reports are that pre-trade data provider Algomi will be bought by interdealer broker BGC. Stu Taylor, formerly the CEO of Algomi, joined BGC...

Reviews of MiFID II transparency raise concerns

The European Securities and Markets Authority (ESMA) launched consultations on 3 February 2020 for the regime for non-equity instrument systematic internalisers (SIs), venues that...

The 2020 vision for primary markets

New platform launches in 2020 will see intense competition to manage the bond issuance process. Dan Barnes reports.

Traders at buy-side firms are looking for...

One desk for multi-asset low-touch trading

If a single desk can trade all liquid instruments for an asset manager, it could see significant cost and process efficiencies. Lynn Strongin Dodds...

Could buy-side share data?

Oscar Kenessey, head of derivatives, fixed income and currency trading at NNIP has suggested that sharing data between asset managers could help to overcome...