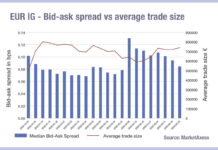

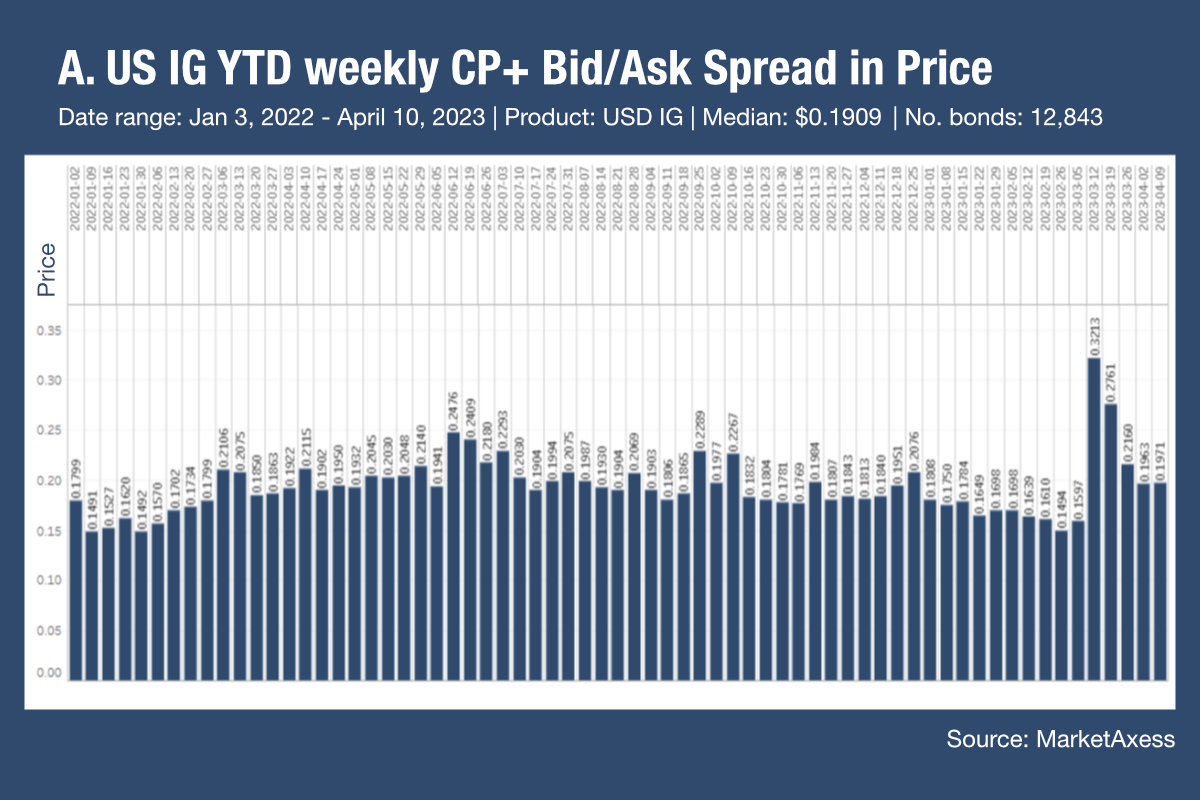

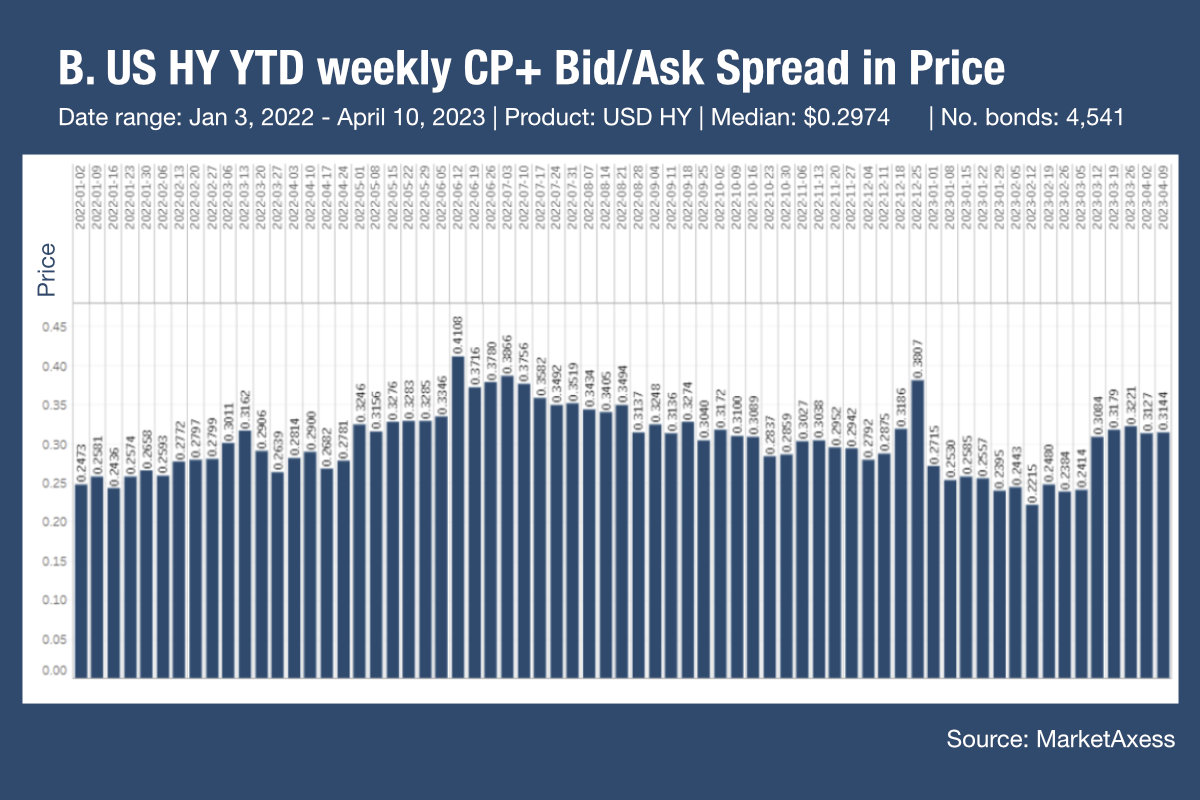

Bid-ask spread remain elevated in US markets across investment grade and high yield, relative to January and February, according to MarketAxess Trax data, which tracks trading across multiple markets and counterparties.

The sense of tension in the markets, which ramped up following the collapse of Silicon Valley Bank, and rescue acquisition of Credit Suisse, has not dissipated. Within credit markets, trading volumes are more range bound, at around US$130 billion average weekly volume for IG bonds and US$46 billion for high yield bonds.

While there has been a predictable drop off in activity over the Easter/Passover/Ramadan holiday period, this suggests that it is pricing volatility which is increasing the bid-ask spread. For buy-side desks this means the cost of liquidity has increased without any corresponding change in volume, so the net position has worsened for buyers and sellers.

Given the need to take advantage of rising rates within fixed income portfolios, it may be that getting access to newly issued bond proves a less expensive route to accessing liquidity as issuers are under greater pressure than dealers in the secondary market.

At the same time, finding solid pre-trade sources of data to use in order to optimise the execution process will prove invaluable as there may be better relative value trades to be done which minimise the effect of additional liquidity costs.

©Markets Media Europe 2023

©Markets Media Europe 2025