Primary markets: Give me some credit: Outlook for bond issuance in 2023

New issues provide liquidity and price points for bond traders; we assess the prospects for the year ahead.

As the cost of borrowing continues to...

Market structure: The alternatives in market making

The DESK profiles five of the major electronic liquidity providers.

Given the strains on market making in fixed income, it is vital that buy-side desks...

The DESK’s Trading Intentions Survey 2021

This year sees tighter pipelines for new business and a wider array of trading protocols.

Executive summary

One year on from the sell-off in Q1 2020,...

Subscriber

Tapping the expanding universe of credit futures and options

Cboe has launched options on Cboe iBoxx iShares Corporate Bond Index futures, and widened its trading hours to further expand the user base and...

Disruption without interruption

David Parker, Head of MTS Markets International (MMI) discusses tapping into the benefits of fixed income trading technology.

Technological advancements are quietly – and sometimes...

Technology : AI paradigms for bond trading

Understanding types of machine learning is key to building automation in bond markets, writes Lynn Strongin Dodds.

The difficulties of applying artificial intelligence (AI) and...

TransFICC: The Network is the Market – Improving access and automation in fixed income

By Steve Toland, co-founder TransFICC.

Remember Sun Microsystems’ tag line from 1984? “The Network is the Computer” – meaning computers should be networked, or they...

BIS targets liquidity cliff in repo

Banks have reacted to end-of-quarter capital reporting by reducing activity, leading to sudden declines in liquidity; now authorities are reacting.

Banks have been ‘window dressing’...

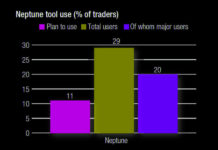

The DESK’s Trading Intentions Survey 2020 : Neptune

NEPTUNE.

The only one of the first-generation, pre-trade data providers to thrive, Neptune is a firm favourite. Described by its interim CEO, Byron Cooper-Fogarty, as...

Subscriber

Liontrust – The trading team built for growth

Matt McLoughlin, partner and head of trading at Liontrust Asset Management, explains why expanding trading capabilities to match AUM and asset class growth needs...