Investment Grade trading: A tale of two markets

By John Gallagher, MarketAxess

Last year, the markets were a one-way trade. Aggressive rate increases leading to horrible returns. Sell everything! And ask questions later......

Case Study – BlueCove’s expansive view of fixed income markets

BlueCove’s expansive view of fixed income markets.

Recognising the need for smarter ways to assess market dynamics and connect with pools of liquidity, BlueCove has been...

Local currency emerging market trading grows at MarketAxess

MarketAxess, the operator of an electronic trading platform for fixed-income securities, has seen a rise in volumes of local currency bond trading in emerging...

Bringing innovation and liquidity to the US Treasuries market

Earlier this month, PIMCO, one of the world’s largest fixed income asset managers, published their view on how to improve the functioning of the US...

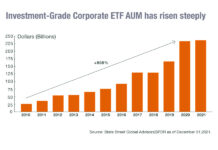

Credit Indices – Closing the Fixed Income Evolutionary Gap

Fixed income markets are evolving at pace, with smarter electronic trading protocols, more sophisticated, automated investment strategies and a greater availability of useful data.

In...

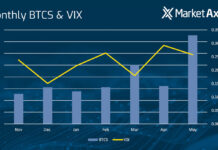

The Loan Lowdown: Volatility’s impact on Leveraged Loans

Howard Cohen, Head of Leveraged Loans at MarketAxess.

Since early April, the leveraged loan market has trended in one direction. Risk assets have continued to...