Bank of England launches SWES test for bond markets

The Bank of England (BoE) has published the latest phase of the System-wide Exploratory Scenario (SWES) with bank and non-bank participants provided a hypothetical...

This! Is! What! Liquidity! Looks! Like!

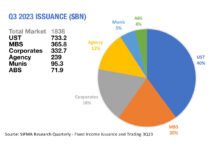

In the past quarter, the average daily notional traded for US Treasuries was 99.5% of the total value of securities issued in the same...

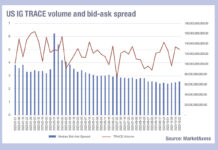

What is crushing the bid-ask spread in US IG?

The bid-ask spread in US investment grade credit has been falling this year, regardless of the trading volume activity.

Notional traded in the US...

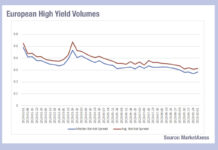

Europe sees big drops in implied liquidity costs

Since the start of 2023, European corporate bonds have seen a greater drop in bid-ask spreads than has been seen in their US investment...

Debt, Outstanding!

The rising level of outstanding debt in the US markets is remarkable – it hit 144% of gross domestic product (GDP) in 2022 according...

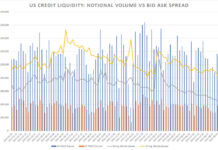

BOB Secondary: US Credit has never had it so good

Liquidity in US credit has improved significantly over the past year, with bid-ask spreads lower than any point in 2022, according to MarketAxess’s CP+...

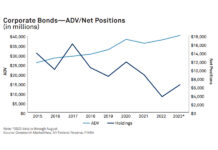

Hold me now!

“Hold me now,

Whoa, warm my heart,

Stay with me!”

This Thompson Twins’ classic could be sung by corporate bonds to the sell-side community, who saw their...

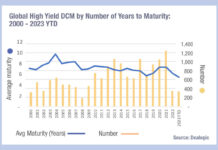

What do shorter durations imply for trading?

Data from Dealogic shows that the average maturity for newly issued bonds has been falling in 2023 relative to recent years, with the current...

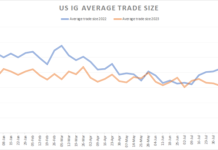

Have US IG trades hit their smallest size this year?

The fires of summer are being replaced by the floods of autumn, but in the bond markets a gentler and more positive outcome is...

Are average trade sizes really falling in the US?

Earlier this year we noted that average trade sizes were down considerably on 2022, but being wary of mean reversion, we wanted to revisit...