Clearlake Capital and Motive Partners to acquire BETA+ from LSEG

Private equity firms Clearlake Capital Group and Motive Partners have agreed to acquire the BETA+ assets from London Stock Exchange Group (LSEG), encompassing the...

Versana to launch syndicated loan platform

Fintech firm Versana is to launch a syndicated loan platform, joining together banks, institutional lenders and their service providers in an effort to bring...

Angelo Proni named CEO of MTS

Angelo Proni has been CEO for bond market operator MTS, part fo Euronext. Taking over from Fabrizio Testa, who was named CEO of Borsa...

Block trading investigations follow a long trend

Several investigations reported in the press are following regulatory scrutiny of block trading arrangements. The investigations reported by Bloomberg, Reuters and the Financial Times...

People: Hunter leaves MarketAxess; Louchard at AXA IM

Nichola Hunter has left MarketAxess as head of its rates business. Hunter joined the firm in 2020 when it acquired government bond marketplace LiquidityEdge,...

SEC warns on counterparty risk in volatile markets

Staff of the Security and Exchange Commission (SEC) division of trading and markets have urged broker-dealers and other market participants to remain vigilant to...

MarketAxess launches MKTX US Investment Grade 400 Corporate Bond Index

Bond market operator, MarketAxess, has launched the MKTX US Investment Grade 400 Corporate Bond Index (MKTX 400 Index). The launch of MarketAxess’ first tradable...

Updated: Bloomberg launches all-to-all bond trading service

Bloomberg has launched Bloomberg Bridge, a new global all-to-all service that supports intermediated trading for corporate and emerging market bonds. Clients will initially be...

Tim Baker joins BMLL to expand firm’s US presence

BMLL, the provider of historical Level 3 data and analytics, has appointed of Tim Baker as senior adviser. Based in New York, Baker will...

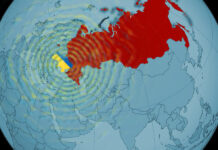

How e-trading connectivity has been fragmented by sanctions

Sanctions on the Russian regime, on associated firms and on individuals have restricted legal access to some instruments and counterparties, yet portfolio managers may...