T. Rowe Price opts for ICE’s Best Execution service

By Flora McFarlane.

Asset manager T. Rowe Price has announced that it will use the Intercontinental Exchange (ICE) Data Services’ Best Execution service for trade...

THETA hires Flanagan amid whirlwind of connectivity ahead of launch

THETA, the specialist provider of buy-side trading technology as a service, has appointed Paul Flanagan as strategic sales advisor, managing relationships with buy-side firms.

Flanagan...

Dom Holland joins LedgerEdge

LedgerEdge, the distributed ledger ecosystem for corporate bond trading, has appointed senior fixed income specialist Dom Holland to the role of business development for...

Vedda moves from global trading role at DWS

Vincenzo Vedda has been named head of client coverage for EMEA ex Germany and global head of wholesale & digital coverage at DWS Group,...

Tom Porcelli named PGIM Fixed Income chief US economist

PGIM Fixed Income, a firm With US$793 billion in assets under management (AUM), has named Tom Porcelli chief US economist, effective 6 July 2023....

GAM raises spectre of illiquidity and redemption

By Pia Hecher.

Global Asset Management (GAM) fund boards suspended all subscriptions and redemptions in its unconstrained/absolute return bond funds (ARBF) on 31 July 2018....

Messaging tools spike as remote trading takes off

Providers of messaging tools used by portfolio managers, buy-side traders, sales traders and sell-side dealers have seen volumes spike as remote working becomes a...

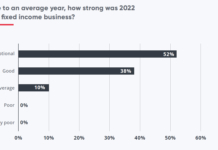

Dealers had ‘exceptional’ 2022 for fixed income; JP Morgan tops Q1 DCM winners

Research by front-office technology provider, valantic FSA, and analyst firm, Acuiti, has found that 52% of dealers had an ‘exceptional’ year for fixed income...

Chappell and Nuyts launch European outsourced trading centre

A new outsourced trading and advisory firm, Sherpa Edge, will launch operations on 1 April led by two highly experienced traders Bart Nuyts and...

Bond funds hit by massive fee discounts; active revenues predicted to fall

Bond funds are dropping their investment management fees by up to 37% - in the case of passive funds – from those of the...