Liquidnet: Traders moving towards alpha capture

By Vineet Naik.

New research indicates that the role of the trader is shifting towards enhancing fund performance by not only the protection, but also...

Coalition: Dealer fixed income stabilising, in a tale of two quarters

By Flora McFarlane.

Analyst house Coalition’s latest report on investment bank activity has shown mixed results for fixed income, currency and commodities (FICC) in the...

PGIM: Research indicates liquidity event is tail risk with greatest impact

In a survey of 400 senior investment decision-makers at institutional investors in Australia, China, Germany, Japan, the UK and the US with a combined...

Analysis: Credit belongs to…

In 2021, electronic credit trading has seen a close fought race between two giants, MarketAxess and Tradeweb. While both have slightly different profiles, through...

CME Group announces Q4 2022 launch of European Overnight Index Futures

Derivatives marketplace operator, CME Group, has announced it will launch European Overnight Index futures based on RepoFunds Rate (RFR) benchmarks and the Euro Short-Term...

BestEx Research launches no-code algo trading tool

BestEx Research Group, a provider of algorithmic execution and measurement solutions for equities, futures, and FX trading, has added a no-code algorithmic trading tool,...

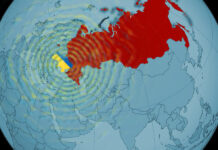

Market disruption spreads beyond Ukraine and Russia

Traders are reported that liquidity across developed and emerging markets is being hit, with trades taking far longer to complete and price formation suffering...

Barclays: Portfolio trading 8% of US credit market volume

Barclays has conducted new analysis into portfolio trading of corporate bonds, estimating the trading protocol now makes up 8% of US credit trading.

The firm...

Moody’s: Speculative-grade credit default rate to rise in 2023

Moody’s Investor Services expects the global speculative-grade corporate default rate to rise in 2023 as slowing economic growth, higher input costs and rising interest...

Hermes appoints Andrew Jackson as head of Fixed Income

Hermes Investment Management, which has £30.6 billion in assets under management, appointed Andrew Jackson as head of Fixed Income, reporting to Eoin Murray, head...