Return of volatility – will liquidity shifts bend or break US Treasuries?

Disclosed trading and internalisation are increasing as liquidity is wrung out of dealers and electronic market-makers. Chris Hall reports.

As January’s storms ripped holes in...

Pre-fight analysis: The weigh-in for CME vs FMX

The launch of FMX, the derivatives exchange chaired by Howard Lutnick, CEO of interdealer broker and services provider BGC Group, sets out a potentially...

SGX anticipates Japanese growth with STIR futures

Singapore Exchange (SGX Group) plans to introduce short-term interest rate futures related to the Tokyo Overnight Average Rate (TONA) and the Singapore Overnight Rate...

Buy side calls for reform in US Treasuries

Treasuries market under the spotlight as US finance ministry takes stock in one of the most sweeping reviews of its kind. Anna Reitman reports.

The...

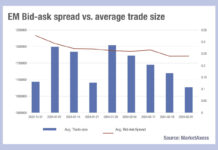

What is driving down EM trading costs?

Analysis of trade size and bid-ask spread data from MarketAxess’s CP+ pricing feed and Trax market data, which tracks activity across markets, indicates that...

Coalition Greenwich: Regulation and macro concerns dominate for derivatives users

A new report, ‘Derivatives Market Structure 2024: Focusing on Capital and Workflow Efficiency’, has found that 58% percent of end users of derivatives, and...

Top tips from TradeTech: Connect debt, derivatives and equity trading

Buy-side traders have observed that close ties in the trading team based on the targets on an investment – be that corporate or government...