Hargreaves Lansdown offers retail investors access to gilts in primary market

Hargreaves Lansdown is giving its clients access to Debt Management Office (DMO) Gilt auctions.

Tim Jacobs, head of primary markets, Hargreaves Lansdown, says, “This...

Calls on UK to issue first green sovereign bond with 10 to 12yr maturity...

A majority of investors and banks are calling on the UK government to issue its maiden sovereign green bond with a 10–12-year maturity next...

SIFMA finds support for shift in benchmarking of 20-year US corporate bonds

The spread for many legacy 20-year US corporate bonds is benchmarked against the 30-year Treasury, but trade body SIFMA has found support for moving...

SEC report highlights dealer threat to buy-side allocations in primary markets

US market regulator, the Securities and Exchange Commission (SEC), has reported buy-side firms feel pressured not to publicly speak out about the challenges of...

Lone Star State drives over $44bn in new US munis at November elections

Voters across the US greenlit more than US$44 billion in new muni bonds at November’s elections, with 55% of all mooted bond measures approved...

Charles River and OpenDoor connect to enhance fixed income offering

By Flora McFarlane.

Charles River has announced a partnership with OpenDoor to provide clients with access to OpenDoor’s all-to-all US Government bond platform, expanding access...

OpenDoor reveals greatest challenge and a turbo-charged match rate

OpenDoor has revealed a significantly high match rate for asset managers on the all-to-all continuous order book it launched in January 2020, to replace...

Regulators to take tougher line on green bonds

Green bonds have become popular in recent years but the lack of transparency over how proceeds are invested has made some investors nervous. This...

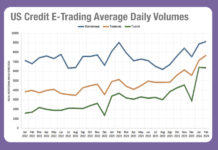

Exclusive: Analysing the battle for US e-Trading in February

The highly competitive corporate bond market saw average daily volumes converge in the US across electronic trading venues in February. The DESK has exclusively...

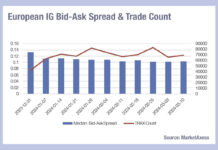

European investment grade seeing smaller, cheaper trades

European investment grade bond traders are seeing a falling bid-ask spread, and a rising trade count since the start of 2024, according to MarketAxess’s...