Vanguard launches ultra-short US Treasury ETFs

Vanguard has expanded its product suite with short-duration and low-volatility US Treasury index ETFs.

The Ultra-Short Treasury ETF (VGUS) will track the Bloomberg Short Treasury...

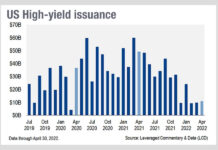

How does the collapse of refinancing affect bond trading?

It costs more to borrow money in the US right now, than it has for a long time. Even more so for companies in...

Is the market braced for another sell-off?

Traders are reporting the positive effects of innovation upon market liquidity but central banks hold all the cards.

The association between the Covid 19 pandemic...

Research: ETFs worsen fixed income liquidity in a crisis

An academic paper has argued that fixed income exchange traded funds (ETFs) “improve bond liquidity in general, but worsen it in periods of large...

Morgan Stanley exec joins Jefferies in Asia

Vivian Li has joined Jefferies as head of distressed trading and credit analytics for Asia. She is based in Hong Kong.

The firm reported US$289k...

Beyond Liquidity: Tokenization could improve bond liquidity & transparency

Bond markets could potentially use tokenization to improve efficiency, liquidity and transparency according to the Hong Kong Monetary Authority (HKMA) as consultancy McKinsey said...

I just dropped in to see what condition my credit was in…

Credit conditions are in the headlines following several private credit defaults, and the debt-fuelled, forward investment in data centres which are expected to underpin...

Lagarde: Capital Markets Union is failing, calls for European SEC to combat national interests

In a speech to the European Banking Congress in Frankfurt on 17 November 2023, Christine Lagarde, president of the ECB, has said the transition...

Managing relationship fragmentation

Jon George and Alex Hardouin of Refinitiv discuss how they are mitigating relationship risk following the firm’s merger with LSEG.

How does the range of...

BIS targets liquidity cliff in repo

Banks have reacted to end-of-quarter capital reporting by reducing activity, leading to sudden declines in liquidity; now authorities are reacting.

Banks have been ‘window dressing’...

When volatility improves credit liquidity

Credit market liquidity has been positive in the first half of 2025, despite the high levels of volatility.

There are several dynamics which might be...

Tradeweb hits US$1.2 trillion quarterly volume in Q1 2022

Tradeweb Markets, the operator of electronic marketplaces for rates, credit, equities and money markets, has reported financial results for first quarter of 2022, with...