On the Desk: Engineering better trading

Honing the trading function is an art; it requires an engineer’s eye for improving systems but a leader’s eye for putting the team first.

How...

FILS 2022: Deferral times priority for consolidated tape plans – EC’s Lueder

Plans for a consolidated tape for fixed income markets in Europe hinge on the “urgent priority” of harmonising post-trade publication windows – keeping them...

Khazen joins LMAX

FX and digital assets exchange LMAX Group has named Ilya Khazen as head of cross-asset sales. Based in New York, he reports to managing...

Angelo Proni named CEO of MTS

Angelo Proni has been CEO for bond market operator MTS, part fo Euronext. Taking over from Fabrizio Testa, who was named CEO of Borsa...

Does trading performance need to be quantified to justify outsourcing?

An asset manager may need to assess the value that an outsourced trading provider offers using a range of measures in fixed income markets.

Fixed...

Tradeweb and FTSE Russell launch US Treasury closing prices

Tradeweb and FTS Russell have expanded their fixed income pricing partnership with the launch of Tradeweb FTSE US Treasury Closing Prices.

The service provides closing...

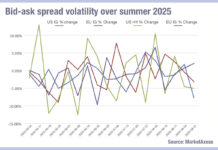

Price volatility in credit

We saw a big drop in average bid-ask spreads (>7%) for US investment grade (IG) last week, possibly a response to the massive levels...

Tradeweb : Bhas Nalabothula : Multi-asset trading

How can traders build out their multi-asset trading capabilities?

For buy-side firms to increase low-touch execution capabilities across instruments,new trading protocols are needed. The DESK...

This Week from Trader TV: Sarah Harrison, Allspring Global Investments

Shifting EU-US credit valuations, navigating data gaps, and the rise of portfolio trading

Sarah Harrison, senior portfolio manager at Allspring Global Investments, discusses the firm’s...

Andrew Westhead named MD research for BestEx Research Group

BestEx Research Group, the execution analytics and measurement service provider for equities, futures, and foreign exchange trading, has appointed Andrew Westhead as managing director...

Trumid gains 71% increase in ADV and US$208 million financing

Bond trading platform Trumid has completed a new US$208 million financing led by Point Break Capital Management, a private investment firm with roots in...

SMBC Group to provide US$2.5bn credit facilities to Jefferies

Sumitomo Mitsui Banking Corporation (SMBC) Group is providing Jefferies with approximately US$2.5 billion in new credit facilities as the firms develop their global strategic...