Tag: Neptune

Technology: Can the EMS become a desktop trading venue?

Direct streaming of dealer prices could allow traders to bypass third party venues, if their desktop systems can be used to execute direct streams...

thinkFolio connects with Lucera’s LumeALFA Analytics and Neptune Axes

IHS Markit, the information, analytics and solutions provider, has established connectivity between its thinkFolio investment management platform and Lucera and Neptune, to support access...

Viewpoint: John Robinson & Byron Cooper-Fogarty

Sharpening the axe: Neptune sees expanding opportunity for buy- and sell-side.

Buy-side firms are consuming more data than ever and Neptune is well placed to ensure...

The DESK’s Trading Intentions Survey 2021 : Neptune

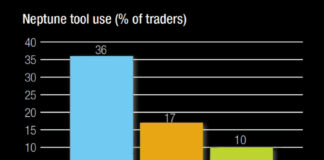

Neptune has expanded its user base to 36% of buy-side traders in 2021 up from 29% in 2020, a considerable increase and one that...

Subscriber

The DESK’s Trading Intentions Survey 2021

This year sees tighter pipelines for new business and a wider array of trading protocols.

Executive summary

One year on from the sell-off in Q1 2020,...

Subscriber

TORA integrates Neptune to boost fixed income OEMS

Trading technology provider, TORA, is integrating its leading order/execution management system (OEMS) with Neptune Networks, the pre-trade data connectivity source. The new connection enables...

Seeing through the pricing mirage

Traders and PMs found real value in using axes over onscreen prices during the recent liquidity crisis.

Neptune’s streaming of dealer axes continues to grow in value...

The DESK’s Trading Intentions Survey 2020 : Unpicking the buy-side workflow

We reveal the buy side’s use of platforms for pre-trade data, executing orders in the market and trading venues.

Trading Intentions Survey highlights

Bloomberg has...

Subscriber

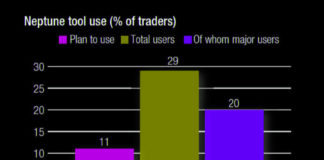

The DESK’s Trading Intentions Survey 2020 : Neptune

NEPTUNE.

The only one of the first-generation, pre-trade data providers to thrive, Neptune is a firm favourite. Described by its interim CEO, Byron Cooper-Fogarty, as...

Subscriber

Pre-trade data: The next generation

The first generation of pre-trade analytics are consolidating; the second generation of price and liquidity providers such as Bondcliq and Katana will need to...