The DESK’s Trading Intentions Survey 2020 : MarketAxess

MarketAxess is rated as the most effective platform for finding liquidity in the corporate bond space by buy-side traders, and is a constant contender...

Subscriber

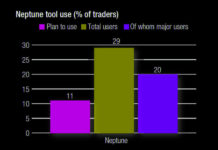

The DESK’s Trading Intentions Survey 2020 : Neptune

NEPTUNE.

The only one of the first-generation, pre-trade data providers to thrive, Neptune is a firm favourite. Described by its interim CEO, Byron Cooper-Fogarty, as...

Subscriber

The DESK’s Trading Intentions Survey 2020 : Streamed dealer prices

STREAMED DEALER PRICES.

Streaming prices from dealers provide a key perspective on the market, but unless they are executable they have limited value for trading....

Subscriber

The DESK’s Trading Intentions Survey 2020 : Tradeweb

TRADEWEB.

A real innovator in the trading protocol space, Tradeweb is constantly vying for the top spot with Bloomberg and MarketAxess.

Its pioneering of portfolio trading...

Subscriber

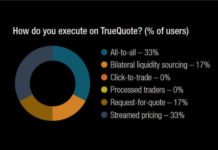

The DESK’s Trading Intentions Survey 2020 : TrueQuote

TRUEQUOTE.

A new entrant in the market in 2019, TrueQuote has seen remarkable success, rapidly building market share and moving quickly to develop trading protocols...

Subscriber

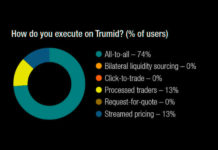

The DESK’s Trading Intentions Survey 2020 : Trumid

TRUMID

Trumid has experienced astounding growth over the past year, with average daily trading volume in January up 325% over January 2019, reaching US$761m, which...

Subscriber

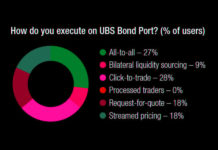

The DESK’s Trading Intentions Survey 2020 : UBS Bond Port

Adopting an agency approach has allowed UBS to deliver a service that has eluded many other banks via Bond Port.

As a result, the...

Subscriber

EMSs connect the dots in bond trading

Increased integration between venues and trading tools could herald far greater automation.

Moving a fixed income order from a portfolio manager to a counterparty is becoming...

Pre-trade data: The next generation

The first generation of pre-trade analytics are consolidating; the second generation of price and liquidity providers such as Bondcliq and Katana will need to...

An EMS built for bond trading

Trading protocols in fixed income are multiplying and becoming more dynamic, placing demands on trading desks that only an EMS can manage.

An execution management...