Technology: Desktop interoperability providers: What’s the difference?

Capital markets firms are improving trading efficiency via desktop interoperability technology, so we look at the different providers.

Desktop interoperability is not a new issue...

EMCA 2023 WINNER: Best Sell-side Fixed Income Trading Desk – Jefferies

Jefferies stands out for commitment to clients and hands-on approach

Buy-side traders have chosen Jefferies as the “Best Sell-side Fixed Income Trading Desk” in this...

Front-to-back OMS providers change strategy

Dan Barnes investigates why big OMS providers are partnering with smaller players.

In 2018, following the acquisition of Charles River Development by State Street, it seemed...

On The DESK: Tobi Molko, Bridgewater Associates

Talent acquisition, automation and the protection of trade data in the year ahead are key priorities for Tobi Molko, head of trading execution at...

The European Markets Choice Awards – The Finalists

Markets Media Europe is delighted to present a preliminary list of finalists for the 2022 European Markets Choice Awards.

The Instinet Positive Change Awards will...

Get it together: Traders seek primary market harmony

With issuance expected to stay high in 2022, traders appeal for a streamlined approach to primary market interfaces.

The level of global bond issuance in...

Low issuance volumes may impact the momentum to reform primary markets

Platforms keen to emphasise longer term commitment to electronification and greater automation.

Multiple platforms have been launched to drive increased efficiency in managing bond issuance,...

Could the Twitter hangover really hurt credit liquidity?

Banks’ support for market making is tied to the bonds they carry on their books, and the cost that has for their balance sheets....

Citi, Deutsche Bank admit breaking competition law in bond trading, finds UK watchdog

By Laurie McAughtry

The UK’s anti-trust authority, the Competition and Markets Authority (CMA), has found that five banks including Citi, Deutsche Bank, HSBC, Morgan Stanley...

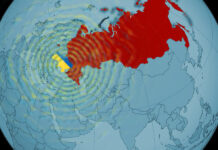

How e-trading connectivity has been fragmented by sanctions

Sanctions on the Russian regime, on associated firms and on individuals have restricted legal access to some instruments and counterparties, yet portfolio managers may...