ICE Data Services: Bond defaults double in Q2

ICE Data Services has seen the level of defaults for bonds double in Q2 2019 to US$7.183 billion, up from US$2.616 billion in Q1...

Tradeweb reports ADV in June up 35% year-on-year

Tradeweb has reported that its total trading volume for June 2021 reached US$23.1 trillion. Average daily volume (ADV) for the month was US$1.05 trillion,...

Buy side finds trading on the turn no less challenging

When everyone was selling and no-one was buying liquidity vanished. However, as bond market outflows lessen, and in some cases reverse, many buy-side traders...

Emerging Markets Focus Part 1: What the flows mean for traders

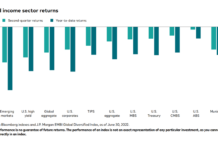

Fixed income sector investments have proven worst for emerging markets funds year to date, according to data from JP Morgan and Bloomberg indices, driving...

“Tourists” in emerging markets challenge liquidity

Emerging markets have had a volatile year, intensifying the pressure on asset managers gain better access to liquidity and pricing. Pinebridge Investments’ Chris Perryman,...

Tradeweb saw ADV hit US$1 trillion in January 2021

Market operator Tradeweb has reported its total trading volume for January was US$20 trillion across its electronic marketplaces for rates, credit, equities and money...

Chinese equity sell-off leaves locals “more cautious” on debt

Buy-side traders in the Chinese debt markets are noting some effect from the equity sell-off, which was triggered by concern around government and regulatory...

New EM issues make relationships matter

Buy-side emerging markets (EM) traders will be bonding well with their banks and brokers this year to make sure they are getting a slice...

EM in ‘limbo’ provides trading and pricing challenges

Emerging market bond funds have seen outflows continue to slow significantly, with Morgan Stanley’s analysts estimating it at US$1.8 billion, equating to about 0.42%...

MarketAxess EM extends coverage to Egypt, Hong Kong and Serbia

Bond market operator and data provider MarketAxess has added Egypt (EGP), Hong Kong (HKD) and Serbia (RSD) to its Emerging Markets (EM) local markets...