Banque de Luxembourg integrates MarketAxess’ Axess IQ order and execution workflow

Banque de Luxembourg, the private banking and wealth management group, has gone live with Axess IQ, the order and execution workflow system by bond...

Top tips from TradeTech: Connect debt, derivatives and equity trading

Buy-side traders have observed that close ties in the trading team based on the targets on an investment – be that corporate or government...

The effect of war on pricing and spreads is widening

The economic effect of the Russian invasion of Ukraine needs to be put in context next to the human tragedy, but data is showing...

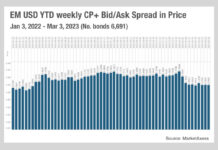

Emerging markets’ uneasy calm

Bid-ask spreads for fixed income trading in emerging markets have stabilised after a tumultuous year in 2022, according to TraX data, triggered by the...

Sherpa Edge appoints Frank Lynge Jensen as chief trader

Outsourced trading specialist Sherpa Edge has appointed Frank Lynge Jensen as chief trader. Lynge Jensen has 21 years’ experience as a trader, working as...

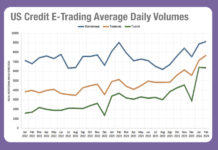

Exclusive: Analysing the battle for US e-Trading in February

The highly competitive corporate bond market saw average daily volumes converge in the US across electronic trading venues in February. The DESK has exclusively...

Greenwich Associates: Growth of electronic trading for EM bonds

A new report from analyst house Greenwich Associates has found that electronic trading of emerging market (EM) bonds has reached 70% amongst US asset...

DTCC proposes equity settlement cycle be shortened to T+1 within two years

The Depository Trust & Clearing Corporation (DTCC), the US post-trade utility has released a two-year industry roadmap for shortening the settlement cycle for US...

Bloomberg wins over AB and Capital Group with BVAL

AllianceBernstein (AB) and Capital Group have both selected Bloomberg's evaluated pricing service (BVAL) to benchmark and corroborate end-of-day values for US fixed income portfolio...

QE: A rush for the exit

Fixed income portfolios need to be reassessed in preparation for the end of asset purchasing programmes. Dan Barnes reports.

Quantitative easing has wound up an...