Greenwich Associates: Fixed income desks see highest buy-side tech spend

Technology spend on buy-side trading desks rose 4% in 2019 from the previous year, to reach US$2.2 million on average, with fixed-income trading desks...

Bond traders report screen prices are off by 10%

Several buy-side fixed income traders have confirmed that electronic prices are currently around 10% off the price that bonds are actually trading at, creating...

“There is no liquidity”: Bond traders report market conditions never seen...

Buy-side bond traders are facing a considerable challenge in matching their investor’s demand for fixed income assets as equity markets plummet. Volumes are up,...

Fixed income up as investment bank revenues and headcount drop

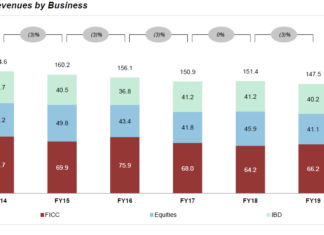

Fixed income, currencies and commodities (FICC) revenues were up 3% year-on-year for investment banks in 2019, halting a two-year slide, according to the latest...

Reviews of MiFID II transparency raise concerns

The European Securities and Markets Authority (ESMA) launched consultations on 3 February 2020 for the regime for non-equity instrument systematic internalisers (SIs), venues that...

Bond trading boosts BNP Paribas’s FICC revenues

BNP Paribas’s investment bank delivered double digit revenue growth in 2019, with revenues for Fixed Income Currencies and Commodities (FICC) up by over 30%....

OpenDoor reveals greatest challenge and a turbo-charged match rate

OpenDoor has revealed a significantly high match rate for asset managers on the all-to-all continuous order book it launched in January 2020, to replace...

Chappell lands new trading role for 2020

Brett Chappell, the former head of fixed income trading at Nordea Investment Management, is joining Mariana UFP, a global financial services business in London...

ICE Data Services: Bond defaults double in Q2

ICE Data Services has seen the level of defaults for bonds double in Q2 2019 to US$7.183 billion, up from US$2.616 billion in Q1...

Changing the liquidity dynamic

US treasury traders are seeing enormous shifts in historical volume and trading patterns. Nichola Hunter, CEO of trading venue LiquidityEdge believes that asset managers...