What’s big, green and keeps traders busy?

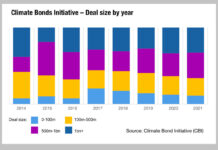

Bond issuance sizes in the ESG space are growing, and the average size of the deals are growing too. The proportion of benchmark-sized deals...

FILS in Barcelona: The modernisation of the bond market

A massive modernisation of the bond market is being recognised at the Fixed Income Leaders’ Summit in Barcelona.

Although the event was largely held...

TradingScreen and Imagine Software to merge; Flatley named CEO of new entity

Private equity firm Francisco Partners, which The DESK revealed has acquired TradingScreen, a provider of trading execution and order management software, is to merge...

Bond market operators see high yield down in Q3 2023 YoY with emerging markets...

MarketAxess saw its US high-yield average daily volumes (ADV) for Q3 2023 drop 20.4% against Q3 2022, standing at US$1.3 billion, while high-grade ADV...

European Commission fines investment banks €371 million for bond trading cartel

The European Commission has found that Bank of America, Natixis, Nomura, RBS (now NatWest), UBS, UniCredit and WestLB (now Portigon) have breached EU antitrust...

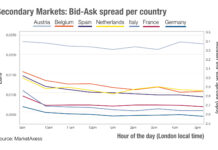

Chart of the week: Trading into Europe

Following our analysis of when to trade into US markets, we examine spreads for European rates markets across the day. For overseas traders working...

LedgerEdge selects Exactpro to support distributed ledger enabled corporate bond trading

Exactpro, a software testing provider for mission-critical financial market infrastructures, has been chosen by LedgerEdge, which is developing a next-generation ecosystem for corporate bond...

Adaptive expands its ‘Operate’ offering, opens Asia office

Electronic trading tech provider Adaptive has expanded its 'Operate' offering to a round-the-clock service and opened its first office in Asia.

Matt Barrett, Adaptive...

Wellington: Internal crossing could have saved US$10-15 million

The Securities and Exchange Commission (SEC) sub-committee the Fixed Income Market Structure Advisory Committee (FIMSAC), has unanimously passed a proposal to support internal crossing...

The inaugural European Markets Choice Awards – shortlist

Best Execution and The DESK are delighted to announce the inaugural European Markets Choice Awards sponsored by Instinet and Tradeweb.

The Awards recognise excellence and...

BrokerTec launches US Treasury benchmark spread trading

Electronic bond market operator BrokerTec, has launched Relative Value (RV) Curve spread trading, allowing clients to trade cash US Treasury benchmark spreads in a...

The breakdown: How asset managers are tackling fixed income unbundling

By Flora McFarlane & Dan Barnes.

With the revised Markets in Financial Instruments Directive (MiFID II) set to arrive in just under five months, buy-side...