Lord Abbett picks IMTC for portfolio, order management

Global asset manager Lord Abbett has appointed IMTC as portfolio and order management system provider.

IMTC will provide an end-to-end investment platform for the US$214...

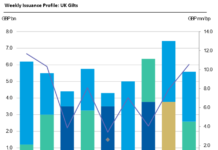

Barnes on Bonds: Primary Gilt Trip

To see political risk writ large in financial markets, look no further than the UK. While Rishi Sunak has won the race to be...

BondCliQ’s new portfolio trade reporting changes understanding of volumes and counterparties

Market data solutions provider, BondCliQ, will be launching a dynamic weekly report which aggregates and analyses data on US portfolio trading (PT) from TRACE,...

Is portability via indirect clearing under threat?

As sell-side relationships are harder to come by, indirect clearing offers hope for smaller buy-side firms, but without mandated asset segregation many may find...

Complex environment requires multi-model approach to data science

In fixed income, the most effective investment and trading models can be those built to withstand uncertainty. Speaking at the Fixed Income Leaders’ Summit...

EC fines Bank of America Merrill Lynch, Crédit Agricole, and Credit Suisse for bond...

The European Commission (EC) has fined Bank of America Merrill Lynch, Crédit Agricole, and Credit Suisse €28.5 million for breaching EU antitrust rules, as...

March sell-off has driven a longer-term shift towards all-to-all trading

Buyers and sellers were successfully finding opportunities in all-to-all trading as traditional liquidity tightened. Does that herald a permanent shift in behaviour?

All-to-all trading came...

Schroders’ former head traders return to senior roles

Rob McGrath, former global head of trading at Schroders, and Nick Robinson, former head of trading for Fixed Income and Active FX at Schroders,...

Asset managers could avoid tying up collateral under new uncleared margin rules

The majority of asset managers dragged into new uncleared margin requirements over the next two years could avoid tying up capital altogether, but still...

ICE rolls out suite of European equity indices

Market and infrastructure operator, Intercontinental Exchange (ICE), has launched around 600 equity indices covering the qualifying, listed security universe across 16 selected European countries,...

Swaps market implies no rate change from FOMC

Data from the swaps market implies participants expect to see policy rates unchanged after the Federal Open Markets Committee (FOMC) meeting this week.

Looking further...

Artis launches new loan product with Etrading Software

Artis Holdings in partnership with Etrading Software has launched its new loan technology to help provide automation and bring efficiency to the loan market.

In...