The Agency Broker Hub: How agency brokers are shedding their skin

By Umberto Menconi, head of Digital Markets Structures, Market Hub, Intesa Sanpaolo Group*

The agency broker has always played one of the principal roles on the...

Exclusive: Vincenzo Vedda reveals DWS’s new trading vision

Vincenzo Vedda, global head of trading at DWS (formerly Deutsche Asset Management) has laid out his vision for the firm’s new trading operations for...

The $21.6 trillion question: How many regulators does it take to change a lightbulb?

The US$21.6 trillion US Treasury market is confounded by a lack of transparency and very short-term liquidity provision, according to a new joint staff...

Kapoor swaps BBVA for HSBC

Sonu Kapoor has joined HSBC as an emerging markets trader, based in New York.

HSBC’s corporate and institutional banking arm reported US$7.1 billion in revenues...

Trading: Regulatory overreach onto the trading desk

Complaints about regulators expanding rules for equity markets into fixed income are rising on both sides of the Atlantic.

The Securities and Exchange Commission (SEC)...

MarketAxess to buy algo provider Pragma

Bond market operator, MarketAxess, has entered into a definitive agreement to acquire Pragma, a quantitative trading technology provider specialising in algorithmic and analytical services...

Leveraged loan market ripe for innovation after 2023 revenue bump

US dealer revenue hit US$900 million in 2023, representing a 16% increase against 2021 and a 29% bump on 2022, attributed to a renewed...

US Treasuries market picks up the electronic pace due to Covid-19

Covid-19 has triggered a “dramatic” shift in US Treasuries, the world’s largest bond market towards electronic execution from traditional voice trading, according to a...

E-trading bond platforms outperform banks’ Q3 in fixed income trading

Market operator Tradeweb has seen a strong Q3 revenue against the same quarter in 2020, while electronic bond-trading MarketAxess has seen a slight decrease...

Report: Over half of dealers being asked for direct price streaming

New research by fixed income price data and analytics provider, BondCliQ, has found that over half of sell-side firms (52%) have been asked for...

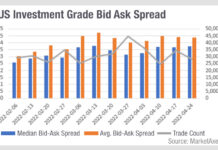

Is US investment grade market-making starting to fray?

In US credit, mean bid/ask spreads are skewing upwards from the median, indicating that a greater proportion of larger spreads are in some cases...

Viewpoint: Lifting the pre-trade curtain

Michael Richter, an executive director at S&P Global Market Intelligence, and head of the Transaction Cost Analysis (TCA) business for EMEA explains the key...