TISE sees bond listings bump thanks to rosy macro picture

The International Stock Exchange (TISE) listed 444 securities during the first half of 2024, an 18.4% increase against the same period last year.

The total...

Changing the liquidity dynamic

US treasury traders are seeing enormous shifts in historical volume and trading patterns. Nichola Hunter, CEO of trading venue LiquidityEdge believes that asset managers...

ICE bolsters fixed income offering as Virtu offloads BondPoint

By Flora McFarlane.

BondPoint, the electronic fixed income securities trading platform, has become the latest addition to Intercontinental Exchange’s fixed income offering.

With the US$400 million...

Bloomberg warns on SEC extending exchange rules into bond market communication protocols

In a letter penned by Bloomberg’s Gregory Babyak, global head of regulatory Affairs and Gary Stone regulatory analyst and market structure strategist, the market...

Handelsbanken Fonder AB adopts Bloomberg’s PORT Enterprise

Handelsbanken Fonder AB, a subsidiary of Handelsbanken managing approximately 100 mutual funds, has adopted PORT Enterprise, Bloomberg’s portfolio and risk analytics solution, to further...

Nicanor Trano promoted at BNP Paribas

BNP Paribas has appointed Nicanor Trano as head of AUD & USD rates trading for APAC.

Trano has 20 years of industry experience, and has...

On The DESK: What it takes to build a multi-asset trading team

Since becoming global head of trading at Schroders, Gregg Dalley has helped his teams become a single, multi-asset trading unit.

The DESK: What is your team’s...

7 Chord’s EM sovereign and corporate bond feed prices on Nasdaq’s Quandl

Predictive bond prices and analytics provider, 7 Chord, has expanded its data offering on Nasdaq's Quandl. Bond investors and dealers can now leverage Python,...

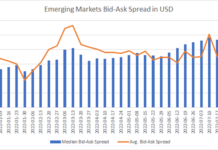

Emerging Markets Focus Part 2: Illiquidity in numbers

When investment flows are heavily directional it can make trading more challenging, as most investment firms are selling into a downward market or buying...

European Women in Finance: Isabelle Girolami – A fresh attitude to risk

Isabelle Girolami has been CEO of LCH Ltd. since 1 November 2019. She has since had to deal with a global pandemic requiring employees...

Rutter launches ambitious new bond ‘ecosystem’, LedgerEdge

David Rutter, founder of US Treasury platform LiquidityEdge and CEO of distributed ledger group R3, has built a team of financial market and technology...

Robeco builds out emerging market debt team

International asset manager Robeco has hired an Emerging Market Debt (EMD) team, consisting of portfolio managers Diliana Deltcheva, Richard Briggs and Nicholas Sauer.

The trio...