MARKET NEWS

US electronic platforms’ credit activity cools further in

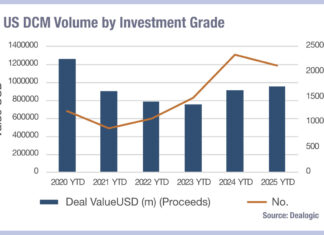

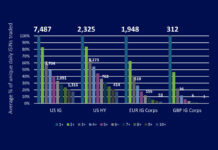

Average daily volume reported on TRACE for US investment grade (IG) and high yield (HY) dropped a further 9% month-on-month (MoM) in June to...

SIX tokenises corporate bonds to expand investor base

SIX Digital Exchange (SDX) has completed its pilot project tokenising corporate debt instruments in collaboration with Banque Pictet.

Fractional quantities of the tokenised assets were...

Kapoor swaps BBVA for HSBC

Sonu Kapoor has joined HSBC as an emerging markets trader, based in New York.

HSBC’s corporate and institutional banking arm reported US$7.1 billion in revenues...

FCA consultation lays ground for ending bond SI regime

The FCA’s consultation CP25/20 proposes scrapping the systematic internaliser (SI) regime for bonds, derivatives, structured-finance products and emission allowances to align with the transparency...

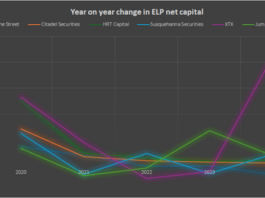

US banks boosted trading assets ahead of new lenient stress test results

Easier 2025 stress test assumptions and friendlier accumulated other comprehensive income (AOCI) treatment have freed capital for American investment banks’ fixed income desks; US...

FairCT wins EU bond CT tender

FairCT has won the EU bond consolidated tape tender.

The company has been invited to apply for authorisation. Once authorised, it will operate the tape...

FEATURES

The pretenders, and kingmakers, to the bond throne

Dealers are backing several new trading platforms who are fighting major incumbents for market share.

In the bond market, the trading platform landscape has been...

Declaration of dependence

US president to oversee financial institution regulation amid deregulation drive.

Executive orders signed by US president, Donald Trump, have given him oversight of all US...

Electric dreams in global rates markets

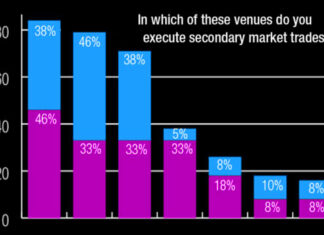

Electronic trading between dealers and buy-side institutions is taking different paths in government bond markets, globally. Lucy Carter investigates.

“We have seen growth in the electronification of...

Trading Intentions Survey 2025

The battle for pre-trade analytics

The 2025 Trading Intentions Survey canvassed 40 buy-side trading desks across asset managers headquartered in Europe (52%) and the US...

Subscriber

PROFILES

RESEARCH

Exclusive: US analysis of Trading Intentions Survey 2025

This year we're diving deeper into the Trading Intentions Survey. to give a more nuanced view of buy-side engagement with trading services, platforms and...

Subscriber

FROM THE ARCHIVES

The Agency Broker Hub: Capital markets digitalisation is flying above the cloud

Loris Buscaino & Paolo Ferracuti, Brokerage & Execution, Market Hub, Intesa Sanpaolo IMI CIB Division.

Cloud-focused partnerships are initiatives that have gathered steam recently, due to...

“There is no liquidity”: Bond traders report market conditions never seen before

Buy-side bond traders are facing a considerable challenge in matching their investor’s demand for fixed income assets as equity markets plummet. Volumes are up,...

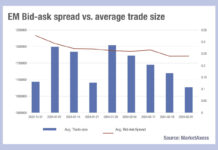

What is driving down EM trading costs?

Analysis of trade size and bid-ask spread data from MarketAxess’s CP+ pricing feed and Trax market data, which tracks activity across markets, indicates that...

Trading Intentions Survey 2018

Greater dependence vs reduced choice

The pipeline of growth is returning after MiFID II, with reliance on specific platforms increasing.

In 2017 the appetite for onboarding...

Subscriber

Liquidnet: 39% of buy-side firms rethinking use of TCA

By Flora McFarlane.

Traditional transaction cost analysis (TCA) could be a casualty in the shifting landscape of pre- and post-MiFID II regulation, with 39% of...

European bond traders struggle with block trades and counterparties

Analysis of the European and US corporate bond markets by Coalition Greenwich has found that block trades and counterparties are a far greater concern...

Bond trading boosts BNP Paribas’s FICC revenues

BNP Paribas’s investment bank delivered double digit revenue growth in 2019, with revenues for Fixed Income Currencies and Commodities (FICC) up by over 30%....

Industry viewpoint : MTS

Work smarter with MTS Auto Execution – trade automation at your fingertips

Paul O’Brien, Senior Product Manager at MTS Markets

Automation has become so imbedded in our everyday...

Editorial: Asset managers wilt as banks impose hose-pipe ban

In the UK, during dry conditions, the government bans the public from using hosepipes in order to conserve water. In 2022, the sell side...

Investor Demand: European corporate debt plays second fiddle to the US

Zachary Swabe, total return portfolio manager for European high yield and global credit at UBS Asset Management, spoke to The DESK about the current...

Allianz GI: On strength of voice

Effectively communicating across trading desks, teams, counterparties and industry is allowing Allianz Global Investors to stand out amongst asset managers. The DESK talks to...

Traders call time on outsized European market open hours

Buy- and sell-side traders have called for Europe to review its equity market open periods, which at eight and half hours is over 30%...