Are issuers predicting a 6% Fed Funds rate?

Bond issuance has continued to beat expectations in February 2023. Last month saw 774 investment grade bonds issued globally, for a notional value of...

The effect of war on pricing and spreads is widening

The economic effect of the Russian invasion of Ukraine needs to be put in context next to the human tragedy, but data is showing...

The UK’s inflation-linked notes getting snapped up

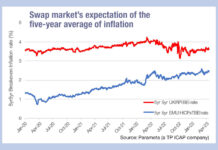

Data from Parameta, the TP ICAP company data and analytics provider, shows the five-year breakeven inflation rate for the UK, which represents a measure...

The vicious circle of trust and liquidity

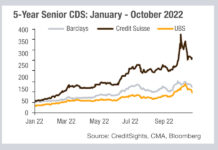

Looking at data provided by CreditSights, we can see the extent of lenders’ concern about Credit Suisse this year. The cost of insuring Credit...

Rising rates but falling demand

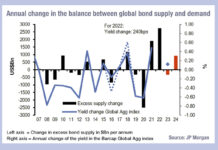

Analysis by JP Morgan’s Global Markets Strategy team, Nikos Panigirtzoglou, Mika Inkinen and Mayur Yeole has cast an interesting light on the prospects for...

What’s big, green and keeps traders busy?

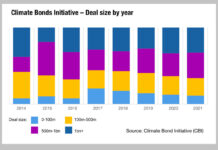

Bond issuance sizes in the ESG space are growing, and the average size of the deals are growing too. The proportion of benchmark-sized deals...

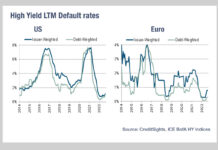

Less distressed debt

The risks of default in high yield credit are one reason cited for reduced sell-side trading activity in the asset class. However, while the...

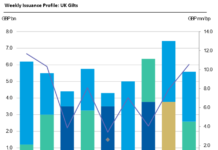

Barnes on Bonds: Primary Gilt Trip

To see political risk writ large in financial markets, look no further than the UK. While Rishi Sunak has won the race to be...

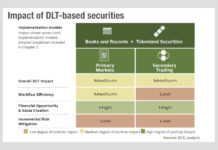

DLT – What is the value in primary markets?

A recent study prepared on behalf of the Global Financial Markets Association (GFMA) by Boston Consulting Group, Cravath, Swaine, and Moore LLP, and Clifford...

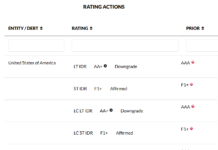

The US: Too big to Fitch?

Ratings agency Fitch has downgraded the United States’ long-term credit ratings to AA+ from AAA and removed the rating ‘Watch Negative’ stating “ reflects...