Lipper: Bond funds come roaring back (with Fed’s help)

Refinitiv Lipper has seen a bounce back for bond funds in Q2 2020 after they suffered losses of -4.3% and outflows of US$208.9 billion...

New EM issues make relationships matter

Buy-side emerging markets (EM) traders will be bonding well with their banks and brokers this year to make sure they are getting a slice...

US Treasuries market picks up the electronic pace due to Covid-19

Covid-19 has triggered a “dramatic” shift in US Treasuries, the world’s largest bond market towards electronic execution from traditional voice trading, according to a...

Jonathan Rick: SOFR First slowly, then all at once

SOFR First slowly, then all at once: Measuring the market transition from LIBOR

Jonathan Rick, Director of Research, Tradeweb

The dealer-to-dealer market’s switch towards the Secured Overnight...

Bloomberg launches RMB-denominated Liquid China Credit Index

Bloomberg has launched the Bloomberg Barclays Liquid China Credit (LCC) Index, designed to track the liquid, tradable portion of the RMB-denominated credit bond market....

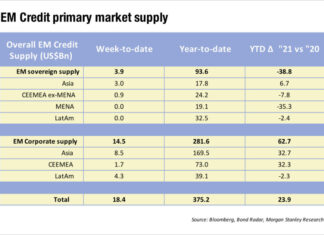

EM in ‘limbo’ provides trading and pricing challenges

Emerging market bond funds have seen outflows continue to slow significantly, with Morgan Stanley’s analysts estimating it at US$1.8 billion, equating to about 0.42%...

CUSIP requests indicate municipal borrowing to rise, corporate to fall

CUSIP Global Services (CGS) has found a significant surge in request volume for new municipal bond identifiers, and a significant decline in request for...

Raiffeisen partners with AxeTrading and Integral to boost bond trading efficiency

Raiffeisen Bank International (RBI) has partnered with AxeTrading, the fixed income trading software company, and Integral, the FX technology provider, to deliver a new...

CME Group to launch 20-Year US treasury bond futures on 7...

Market operator CME Group will expand its benchmark US Treasury futures and options offering with the addition of 20-Year U.S. Treasury Bond futures on...

TMPG meets to discuss key challenges in the Treasury market structure

The Treasury Market Practices Group (TMPG), an industry roundtable coordinated by the US Federal Reserve (The Fed) met on Tuesday 19 October to discuss...