Research: Trading Protocols Survey 2022

In comp vs non-comp trading polarises across electronic and voice.

The DESK’s Trading Protocols Survey 2022 has found a continuing movement of corporate bond trades...

Enrico Bruni – The advantage of a diversified business

Enrico Bruni, managing director and head of Europe and Asia Business at Tradeweb, discusses the challenges posed by current market conditions.

How has the current...

Corporate bonds : E/OMS politics : Anna Reitman

GATEKEEPERS TO LIQUIDITY.

E/OMS providers need to overcome political hurdles to help the buy side navigate credit’s fractured markets. Anna Reitman investigates.

Vendors and brokers that...

Build your own EMS

Frustration with commercial front office technology is leading major buy-side firms to build execution capabilities.

Buy-side spend on order management and execution management systems (O/EMS)...

A flying start to 2024 in European bonds may punish traders

The new year has seen a flying start in bond issuance in Europe, with a strong start relative to recent years driving €8.6 billion...

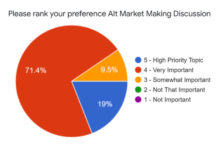

Credit Market Structure Alliance: The real market agenda

The CMSA, invitation-only event, is setting an agenda based on market professionals’ concerns, and has captured a groundswell of interest.

The DESK: What has been...

LedgerEdge: Building low- and high-touch trading in a mutually inclusive model

Tailoring workflows within a distributed environment will allow traders to simultaneously optimise electronic execution and relationship-based trading.

FILS Daily: What effect have the increasingly volatile...

FMSB publishes final standard for the sharing of investor allocation information

The FICC Markets Standards Board (FMSB) has published the final standard for the sharing of investor allocation information in the fixed income primary markets.

Syndicate...

John Orrock joins Cowen fixed income outsourced trading

Cowen has expanded its fixed income outsourced trading team with the appointment of John Orrock as managing director. He will be based in the...

ICMA: Fully-automatic credit trading has grown; block liquidity has reduced

The International Capital Markets Association has found 44% of buy-side trading desks have increased their use of rules-based, fully automated electronic execution compared with...

Virtu Financial forms consortium to expand RFQ-hub

Virtu Financial, the market maker, broker and financial services technology provider, has formed formation of RFQ-hub Holdings to support the growth of RFQ-hub, Virtu’s...

Building a Better Credit RFQ

By Iseult E.A. Conlin, CFA, Managing Director, U.S. Cash Credit, Tradeweb.

Tradeweb Credit is breaking records in 2021, especially in electronic RFQ. Whether it’s total volumes,...