Bank of England releases detail on index-linked gilt purchases as LDI woes continue

The Bank of England (BoE) has said it continues to monitor developments in financial markets very closely in light of the significant asset repricing...

Handelsbanken Fonder AB adopts Bloomberg’s PORT Enterprise

Handelsbanken Fonder AB, a subsidiary of Handelsbanken managing approximately 100 mutual funds, has adopted PORT Enterprise, Bloomberg’s portfolio and risk analytics solution, to further...

Under the skin of new US crossing rules

Crossing trades internally would have saved US investors many millions in March. Dan Barnes reports.

US market regulator the Securities and Exchange Commission (SEC) is...

Behavox snaps up Mosaic for transaction data insights

Data services provider Behavox has acquired Mosaic Smart Data as it prepares to release a trade surveillance product.

Mosaic aggregates internal and external transaction data...

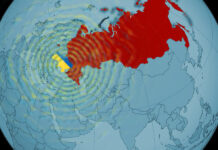

How e-trading connectivity has been fragmented by sanctions

Sanctions on the Russian regime, on associated firms and on individuals have restricted legal access to some instruments and counterparties, yet portfolio managers may...

Tim Baker joins BMLL to expand firm’s US presence

BMLL, the provider of historical Level 3 data and analytics, has appointed of Tim Baker as senior adviser. Based in New York, Baker will...

CME to launch rates futures based on Mexico’s F-TIIE

Derivative and rates market operator, CME Group, is to introduce interest rate futures based on the Central Bank of Mexico's Overnight TIIE funding rate...

Treasury futures open interest shows record uncertainty; surpasses 17 million contracts

Derivatives market operator, CME Group, reports that open interest (OI) in its US Treasury futures reached a record 17,222,551 contracts on 12 May, the...

TS Imagine launches cross-asset investment and trading platform for hedge funds

TS Imagine the trading, portfolio, and risk management platform provider, has launched TS One, a cross-asset class, software-as-a-service (SaaS) platform, designed for investing...

Tradeweb confirms purchase of Australian bond trading platform Yieldbroker

Multi-asset market operator, Tradeweb Markets has entered into a definitive agreement to acquire Yieldbroker, an Australian trading platform for Australian and New Zealand government...

Rates: The risk of weighting sovereign debt

By David Wigan.

Sweden’s sovereign move has fired a risk weight debate. David Wigan reports.

One of the lessons of recent European economic history is that...

TP ICAP in talks to buy Liquidnet

Interdealer broker TP ICAP is in advanced discussions to take over block-trading equity and bond trading market operator Liquidnet for US$700 million.

Liquidnet has a...