Trending Now

MARKET NEWS

RBC joins ICE Clear Credit as clearing member

The Royal Bank of Canada (RBC) has joined Intercontinental Exchange’s (ICE) credit default swaps clearinghouse, ICE Clear Credit, as a clearing member.

Following its membership,...

Citi boosts EGB rates trading team across US and Europe

Citi has made a number of appointments to its rates trading team, with Courtenay Watson joining the company as a managing director in London.

Watson...

Meet the consolidated tape contenders

Europe’s development of a consolidated tape for trading data now has clear front runners, and benefits.

Three firms have confirmed they will compete to be...

Broadridge partners with MultiLynq to accelerate connectivity

Corporate bond trading firm LTX, a subsidiary of Broadridge Financial Solutions, has integrated with MultiLynq to accelerate connectivity to its platform.

MultiLynq provides liquidity and...

Citi invests in Cicada to boost institutional e-Trading of Mexican govies

Citi has made a minority investment in Cicada Technologies in order to boost the electronification of the US$500 billion Mexican fixed income market. Citi...

“Game-changing reforms” needed to fix Europe’s capital markets, say European associations

A new report from three leading market associations outlines an ambitious roadmap to improve the competitiveness of capital markets in Europe through a combination...

FEATURES

Jupiter AM: Training to trade against heavyweight rivals in fixed income

Jupiter Asset Management has trained its trading team on data and analytics in order to beat its rivals to the punch when finding liquidity...

Buy side hails positive development of STP for bond issuance

Risk warning lights flashing on buy-side trading desks could be assuaged thanks to industry collaboration on primary markets.

It seems incongruous that the 50-year old...

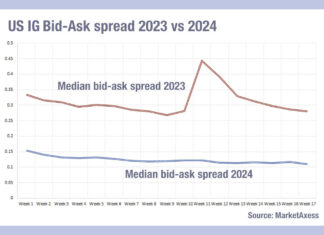

Balancing short and long term liquidity provision

Best execution on a trade-by-trade basis is too simplistic a measure of liquidity provision; The DESK looks at best practice for longer term liquidity...

The Tenth Annual Trading Intentions Survey

Key parts of bond market electronification are still up for contention, with stiff competition across pre-trade, primary and secondary market services.

In 2024 The DESK...

Lars Salmon: On internal strength

Fidelity International has homegrown internal expertise and tech, to support a fixed income trading team that can weather all markets.

Lars Salmon is head of...

Systematic, hydromatic; can credit get as fast as greased lightning?

Some investment firms have claimed they can fully systematise credit trading by 2025, The DESK investigates.

Investment managers and banks are rapidly adopting systematic approaches...

PROFILES

RESEARCH

The Tenth Annual Trading Intentions Survey

Key parts of bond market electronification are still up for contention, with stiff competition across pre-trade, primary and secondary market services.

In 2024 The DESK...

FROM THE ARCHIVES

SEC’s issuer proposal on cyber security risk ‘a step further than Sarbanes Oxley’

US market regulator, the Securities and Exchange Commission (SEC), has proposed amendments to its rules to enhance and standardise disclosures regarding cybersecurity risk management,...

Industry viewpoint : Accessing China’s bond market with HSBC

Outlining the market impact of the latest changes in the Chinese bond market, Tony Shaw, Head of Institutional Sales APAC at HSBC, discusses the...

Karim Awenat – naturally curious

Karim Awenat, Invesco's head of fixed income trading, London discusses the skillsets, culture and technology needed to navigate the bond markets.

What are the challenges...

Union Investment imposes a purchase ban on Russian state bonds and sanctioned companies

Union Investment has decided to impose an immediate ban on the purchase of all securities of the Russian state and a number of Russian...

Derivatives : Migrating benchmarks : Dan Barnes

LIBOR: WHEN TO JUMP ON THE SOFR

The transition from the London Interbank Offered Rate (LIBOR) to overnight indexed swap rates is moving, but when...

Regulation Brings TradFi and DeFi Worlds Together

The European Union passed a legal framework for crypto-assets in the region in April this year, covering markets that are not regulated by existing...

Primary markets: Give me some credit: Outlook for bond issuance in 2023

New issues provide liquidity and price points for bond traders; we assess the prospects for the year ahead.

As the cost of borrowing continues to...

Fed breaks silence on HFT in treasuries

Having opened the US government debt market to high-frequency trading, authorities now push market participants to “be good citizens”. Dan Barnes reports.

The Federal Reserve...

What bond traders need to know about today’s TP ICAP / Liquidnet deal

Broker dealer TP ICAP has agreed to buy block-trading market operator Liquidnet, with Nicolas Breteau, CEO of TP ICAP, putting the growth of Liquidnet’s...

Fixed Income Leaders : The DESK

Fixed Income Leaders – Expectations for 2018

The DESK spoke with members of the advisory panel for FILS Amsterdam to assess the likely agenda.

In November 2018,...

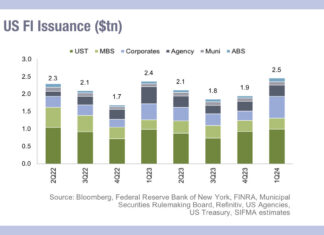

US fixed income issuance down 12%, ADV up 13.5%, in Q3 2023 YoY

Total US fixed income issuance for Q3 2023 saw a 12% drop (from US$1.8tn) against the same quarter in 2022, and down 12.8% against...

Primary markets see gradual progress as Investor Access reaches 600 buy-side users

A quick straw poll of buy-side traders suggests most believe the electronification of primary markets has stalled somewhat, with twice as many seeing progress...