Shielding from exploding issuance

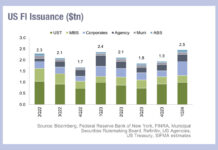

US fixed income markets saw issuance in Q1 2024 hit US$2.5 trillion according to the Securities Industry and Financial Markets Association (SIFMA), an increase...

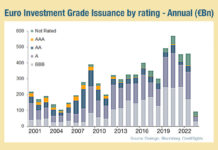

Europe’s record IG credit issuance could boost electronic trading

January was a record month for investment grade bond issuance in Europe, with shorter-dated driving this activity. According to analyst firm CreditSights, shorter maturity...

Emerging markets’ big issues in 2022

According to analysis by CreditSights, there has been a negative total return for credit in emerging markets with the exception of Gulf Cooperation Council...

Are issuers predicting a 6% Fed Funds rate?

Bond issuance has continued to beat expectations in February 2023. Last month saw 774 investment grade bonds issued globally, for a notional value of...

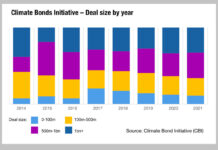

What’s big, green and keeps traders busy?

Bond issuance sizes in the ESG space are growing, and the average size of the deals are growing too. The proportion of benchmark-sized deals...

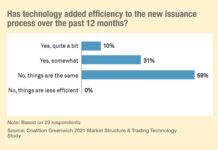

New issuance process unchanged for 59% of traders despite electronification

New research from analyst firm, Coalition Greenwich, has found that 59% of traders are still waiting to see an improvement in the new issue...

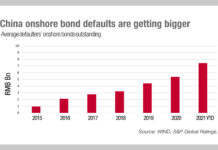

China focus: The outstanding debt of defaulters

Concern around issuer defaults in China is clearly based upon good evidence; our chart this week from S&P Global Ratings shows the annual growth...

Can primary markets deflate?

Inflation levels could have a direct impact on volume of work – and therefore operational pressure – on buy-side trading desks.

Managing the process of...

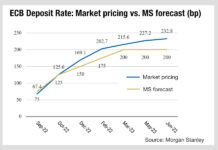

Chart of the week: ECB rates rise expectations

Expectations on the European Central Bank’s appetite to increase its interest rate will have a direct and negative impact on European bond trading which...

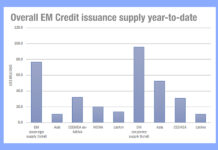

Issuance and inflows paint more positive picture for EM liquidity

Over the past week emerging markets (EM) credit issuance saw US$7.6 billion in newly issued bonds, against US£900k the week before, while on the...