According to analysis by CreditSights, there has been a negative total return for credit in emerging markets with the exception of Gulf Cooperation Council countries, although the outlook for credit from the largest corporate groupings has been more positive with the exceptions of Brazil, LATAM ex-Mexico/Brazil and Asia high yield (HY).

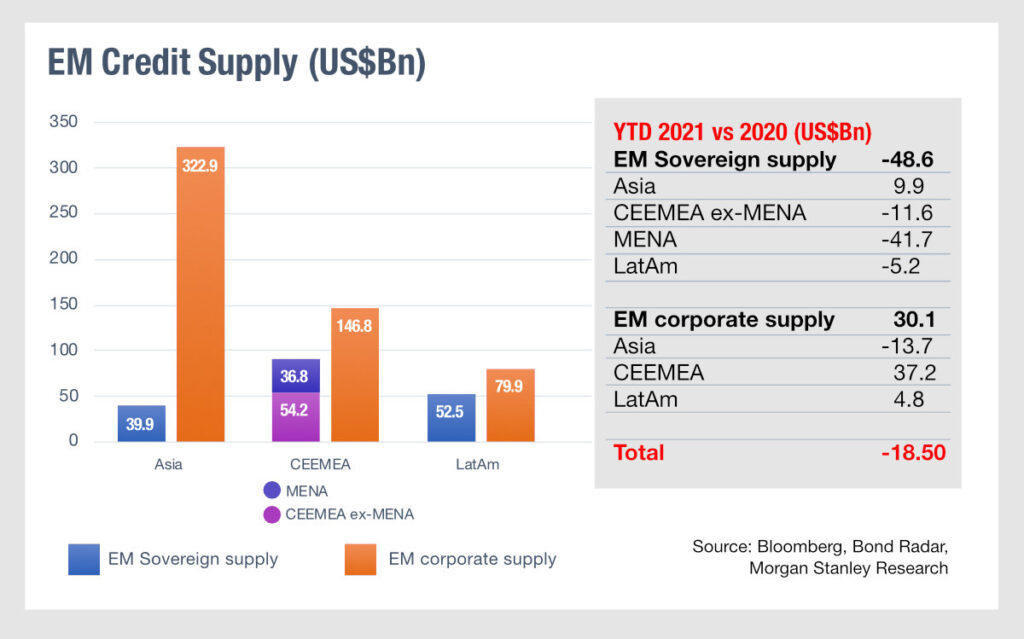

Cross referencing this with issuance as assessed by Morgan Stanley, we can see that although the new supply of credit in Asia Pacific has fallen by 13.7% although it is still by far the largest region by issuance.

By contrast credit issuance in Central and Eastern Europe, Middle East and Africa (CEEMEA) increased by 37.2% over 2020, and issuance in LatAm also rose by 4.8%. At the same time, sovereign supply rose in Asia, while CEEMEA saw a drop of 26.65% against 2020 levels, and LatAm a 5.2% drop.

Although we typically associate more issuance with greater liquidity, when hard currency credit issuance is extremely heavy, during periods of economic uncertainty, this can have a negative effect.

In addition to new variant COVID concerns, the economic woes of Turkey and tensions on the Ukraine/Russia border have created macros weakness. Liquidity can suffer if heavy issuance occurs just ahead of that weakness, which can mean that when markets turn there is underperformance in recently issued curves, where investors were full of the recent issues.

Looking ahead at next year, there is considerable likelihood of further turmoil, along with central bank policy in the US having a direct impact on hard currency issues and central bank activity in EM markets.

Traders taking on big orders would be well-minded to consider the impact shocks can have upon liquidity in the short term, especially if they have limited time due to handling large issuance volumes. Good luck for 2022.

©Markets Media Europe, 2021

TOP OF PAGE