Chaucer: Cost of insurance against defaults on sovereign debt jumps by 102%

The cost of insuring against sovereign debt defaults has increased by an average of 102% over the past year, according to research by global...

Tradeweb reports ADV in June up 35% year-on-year

Tradeweb has reported that its total trading volume for June 2021 reached US$23.1 trillion. Average daily volume (ADV) for the month was US$1.05 trillion,...

First trades of CME’s Mexican F-TIIE interest rate futures

Market operator the CME Group has processed the first trades of the new interest rate futures based on the Central Bank of Mexico's Overnight...

Margin calls for bitcoin futures pose systemic threat

AIG failed in 2008, because the value it placed upon the mortgages underpinning the credit default swaps it had sold to Goldman Sachs was...

Arteria AI gets strategic investment co-led by Citi SPRINT and BDC Capital

Arteria AI, an enterprise digital documentation specialist, has received strategic investments from Citi Spread Products Investment Technologies (SPRINT), the strategic investing arm of the...

IHS Markit publishing new CRITR US dollar funding rate

Information, analytics and solution provider, IHS Markit, is now publishing a series of forward-looking dynamic term rates that measure the daily US Dollar (USD)...

UniCredit and ACTIAM join Trad-X’s dealer-to-client platform

Trad-X, the trading platform for interest rate derivatives, has added UniСredit as a dealer and ACTIAM as a non-dealer to its dealer-to-client (D2C) electronic...

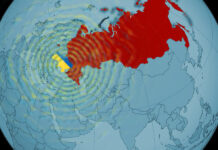

How e-trading connectivity has been fragmented by sanctions

Sanctions on the Russian regime, on associated firms and on individuals have restricted legal access to some instruments and counterparties, yet portfolio managers may...

Obligation to clear could be delayed to 2019 for smaller derivatives users

For financial counterparties, and certain funds classified as non-financial counterparties, whose individual aggregate positions in over-the-counter (OTC) derivatives are €8 billion or below, the...

CME Group to offer futures and options on Treasuries repo financing rate

By Flora McFarlane.

CME Group has announced that will launch futures and options based on the broad Treasuries repurchase agreement (repo) financing rate, set as...