EM debt funds on a winning streak for inflows

According to Morgan Stanley analysis, emerging market (EM) debt funds have seen eight weeks of inflows over the summer period, representing the longest streak...

SSGA: Treasuries, convertibles and EM on the cards for 2019

By Vineet Naik.

State Street Global Advisors (SSGA) is predicting that US Treasuries, convertible bonds and emerging market (EM) debt will see increased investment in...

Tradeweb reports ADV in June up 35% year-on-year

Tradeweb has reported that its total trading volume for June 2021 reached US$23.1 trillion. Average daily volume (ADV) for the month was US$1.05 trillion,...

Emerging Markets Focus Part 1: What the flows mean for traders

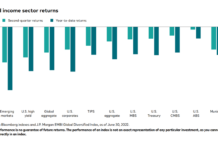

Fixed income sector investments have proven worst for emerging markets funds year to date, according to data from JP Morgan and Bloomberg indices, driving...

EM in ‘limbo’ provides trading and pricing challenges

Emerging market bond funds have seen outflows continue to slow significantly, with Morgan Stanley’s analysts estimating it at US$1.8 billion, equating to about 0.42%...

“Tourists” in emerging markets challenge liquidity

Emerging markets have had a volatile year, intensifying the pressure on asset managers gain better access to liquidity and pricing. Pinebridge Investments’ Chris Perryman,...

Trumid launches emerging markets trading

Fixed income market operator Trumid, has launched emerging markets bond trading on its Trumid Market Center platform.

Market Center connects fixed income professionals to a...

Chinese equity sell-off leaves locals “more cautious” on debt

Buy-side traders in the Chinese debt markets are noting some effect from the equity sell-off, which was triggered by concern around government and regulatory...

Coalition: Banks’ FICC trading victory in 2020 through remote working and market volatility

Remote working did not hold back sell-side firms in 2020 according to data from analyst firm Coalition. Full year investment banking revenues increased by...