CME Group completes migration of BrokerTec trading platform to CME Globex

Market operator CME Group has migrated the US Treasuries trading and US repo functions of BrokerTec business to its CME Globex platform. This follows...

Regulation Automated Trading – The finishing line

Lynn Strongin Dodds asks whether the CFTC can get the bill passed before the election and what its impact will be if it does.

The...

OpenDoor nets US$10 million in continuing push for growth

By Flora McFarlane.

New Jersey-based startup trading platform OpenDoor Securities has completed a third US$10 million investment round, which will facilitate new front office hires...

In 2021 we see record secondary markets trading for European Government Bonds

By Emile Figueiras, European Government Bond Product Specialist, MarketAxess

Secondary market volumes in European government bonds (EGBs) have grown significantly over the last 2 years....

BondCliQ’s new portfolio trade reporting changes understanding of volumes and counterparties

Market data solutions provider, BondCliQ, will be launching a dynamic weekly report which aggregates and analyses data on US portfolio trading (PT) from TRACE,...

Overbond launches real-time AI bond pricing trading product

Fixed income analytics provider, Overbond, has launched COBI-Pricing LIVE, a new real-time AI bond pricing product. COBI-Pricing LIVE is designed to process real-time historical...

Revisiting corporate credit amidst market volatility

By Edward Perks (Executive Vice President, Chief Investment Officer, Franklin Templeton Multi-Asset Solutions).

In 2018, rising inflation, higher US interest rates and escalating trade tensions...

ICE Data Services: Bond defaults double in Q2

ICE Data Services has seen the level of defaults for bonds double in Q2 2019 to US$7.183 billion, up from US$2.616 billion in Q1...

Banque de Luxembourg integrates MarketAxess’ Axess IQ order and execution workflow

Banque de Luxembourg, the private banking and wealth management group, has gone live with Axess IQ, the order and execution workflow system by bond...

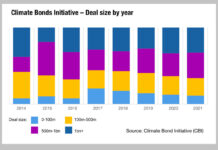

What’s big, green and keeps traders busy?

Bond issuance sizes in the ESG space are growing, and the average size of the deals are growing too. The proportion of benchmark-sized deals...