MayStreet expands cash treasury offering with Fenics data

MayStreet, the market data infrastructure provider, has added Fenics US Treasuries (Fenics UST) to its US cash treasury data portfolio. Owned and operated by...

Editorial: Oversight of US bond markets is broken

Oversight of the US bond markets is broken. The world’s sixth largest bank by assets, JP Morgan, was able to manipulate the US Treasury...

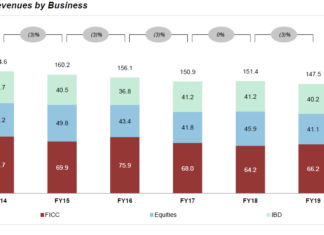

Fixed income up as investment bank revenues and headcount drop

Fixed income, currencies and commodities (FICC) revenues were up 3% year-on-year for investment banks in 2019, halting a two-year slide, according to the latest...

Overbond taps AWS to deliver real-time pricing calculations

Fixed income analytics provider Overbond has launched a new real-time AI bond pricing engine that utilises the latest data processing serverless cloud architecture from...

SoftSolutions’ new testing-as-a-service environment live

SoftSolutions, the fixed income trading technology provider, has announced that a major Scandinavian bank is completing testing of the latest version of nexRates using...

Profile : Paul Squires : Navigating uncharted territory

Paul Squires, Head of the EMEA Equities and Henley Fixed Interest dealing teams at investment management company Invesco discusses the benefit of experience, the...

State Street serves up ‘Cods and Chips’ in European bond market...

State Street has helped to uncover chatrooms, including one called "Cods and Chips" that are alleged to have been used by sell-side traders to...

Coalition: FICC up 50% for banks in H1, rates revenues doubled

Banks saw fixed income, currency and commodities (FICC) revenues rise by 54.6% in the first half of the year according to analyst firm Coalition....

Tradeweb announces JSCC clearing for MTF and SEF Yen swaps

Multi-asset market operator, Tradeweb has reported that institutional clients executing Japanese Yen swaps on its multilateral trading facilities (MTFs) and swap execution facilities (SEFs)...

Analysis: Market response to US Treasury’s increased borrowing needs

The US Treasury’s need to increase debt issuance, beyond market expectations, has had several effects. Firstly there was a ratings downgrade of the USA...