November gives Tradeweb its second highest month’s ADV ever

Market operator Tradeweb has reported today total trading volume for November of US$18.7 trillion across its electronic marketplaces for rates, credit, equities and money...

The implication of falling US HY Issuance

Anecdotally, we hear that new issuance of high yield bonds in European markets directly impacted secondary market liquidity. Looking at the latest data from...

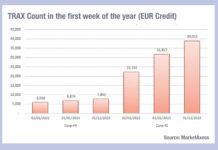

Does this year start with the smallest trades ever?

Trading activity in European bond markets at the start of 2024 has had the highest trade count of the past three years by some...

Record volumes reported across platforms

By Vineet Naik.

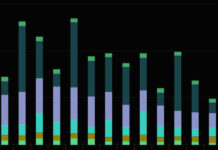

Record trading volumes have been reported across platforms in 2019 despite decreased volatility and challenging market conditions. LiquidityEdge, TradeWeb, and MarketAxess have...

Eurex launches the first futures on a Euro High Yield Index

From 17 October 2022, Eurex will offer market participants the opportunity to hedge the Euro-denominated high-yield corporate bond market in Europe.

This segment has been...

BIS: Cut your trading costs in half by cosying up to dealers

A new working paper, written by the Monetary and Economic Department of the Bank of International Settlements, has found that dealer relationships are crucial...

ICE freezes bond indices until 30th April

The Intercontinental Exchange’s (ICE’s) ICE Data Indices (IDI) has postponed the rebalancing of all the ICE and ICE BofA indices for bond, preferred and...

ICE Data Services: Bond defaults double in Q2

ICE Data Services has seen the level of defaults for bonds double in Q2 2019 to US$7.183 billion, up from US$2.616 billion in Q1...

Can you guess which market has seen the greatest fall in bid-ask spreads, year-to-date?

Two weeks ago, we asked what was crushing the US investment grade (IG) market’s bid-ask spread. However there has been an even greater reduction...

Electronic trading volume in US fixed income hits record

Electronic trading of US investment-grade and high-yield bonds reached an all-time high in July according to data from Coalition Greenwich.

Overall electronic trading accounted for...